Private schools with charitable status in England and Wales receive £144 million per year in local taxation relief, new research has found.

The report, published on 14 July 2022 by Private Education Policy Forum (PEPF), has analysed data from 267 councils during the financial year 2019-20 to form both a national and regional picture of the total amount saved.

The figures come as Labour leader, Sir Keir Starmer, earlier this week repeated his pledge to scrap private schools’ charitable status if the party comes to power.

Around 72 percent of schools affiliated with the Independent Schools Council have the status of a charity. In England and Wales they are obliged to pay only 20 percent of their tax assessments.

Lead report author Francis Green, PEPF board member and professor of work and education economics, UCL Institute of Education, said:

“The large amount of money saved by private schools as a result of tax relief on their business rates deprives local councils of much-needed resources for the delivery of local services, including state education.

“The removal of private schools’ business rates relief would contribute to narrowing the private-state gap in education resources. Though such a reform would only go a little way to resolving the unfairness that stems from the private/state school divide, it would be a step in the right direction and broadly welcomed by the large majority of the public who do not participate in the private education sector.”

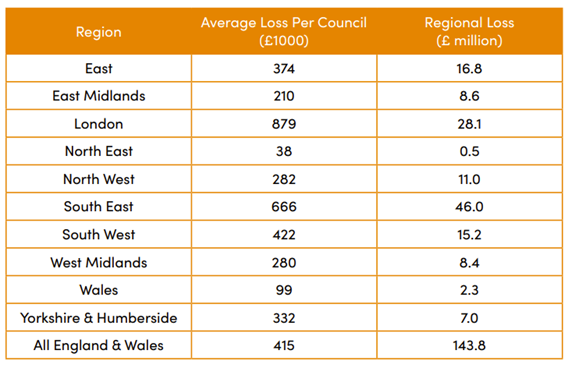

In London, where there is a high concentration of private schools, a total of £28.1 million worth of tax was not paid in the year before the COVID-19 pandemic, amounting to an average of £879,000 per council.

Some councils lost out on much higher sums, such as Kensington and Chelsea, which could have received £3.15 million if the private schools in the area paid 100% of their tax assessment.

Elsewhere, private schools in Wales saved a total of £2.3 million of tax, which equates to an average of £99,000 per council. That figures rises to £666,000 per council in South East, which has the highest deficit per council outside London.

PEPF’s figures, on the benefit accrued to private schools through charitable relief, are higher than had been estimated by consultants CVS in 2016, who put the figure at £522 million over five years. Without factoring in inflation, PEPF estimates a saving to private schools – and a loss to local councils – of £720 million over a five-year period.

The report comes after Scotland removed charitable status from private schools in April, as recommended by the 2016 Barclay Review, and with Labour leader, Sir Keir Starmer pledging to do the same in England and Wales if the party comes to power.

The government recently decided to leave private school business rates unchanged in England. Most private schools also benefit from VAT exemption, valued at £1.6 billion per annum.

The PEPF researchers obtained figures from twice as many councils as CVS, making its findings potentially more accurate.

Average relief from business tax for private schools, by region/nation.